I don’t know who I like trolling more; nocoiners, libertarians, liberals, Tesla shorts, or value investors. Today I’m going to have some fun at the expense of value investors. It’s a bit of payback for all the value investor stabs they give bitcoiners like:

- Bitcoin is a bubble

- Tulip mania

- It doesn’t produce any cash flow

- It has no intrinsic value

- You’re just speculating

- This isn’t investing

- It’s like trading sardines

It’s going to be fun because, as you (and they) will see, I actually understand value investing. Which is a bit different since they’ve never actually taken the time to try and understand bitcoin.

What’s fun about poking fun at value investors is that they’re usually a bunch of old men who believe themselves to be contrarian thinkers, yet they haven’t really had any new ideas since 1950. Though they have butchered the term value investing so much over the years that value investing, the term, is pretty much bereft of any real meaning.

Side note: Have you ever been to Omaha when the Oracle preaches to his congregation? You’ve never seen so many contrarians who think exactly alike. Isn’t it funny that they give bitcoiners shit for being in a cult? See, we’re not so different, bitcoiners and value investors.

They’re quite tough as well, which makes making fun of them even more fun. You kind of have to be tough if you’ve underperformed your competition for the last 20 years.

“One day the mean will revert, and we’ll outperform again!” Yes old man, and if wasn’t for that pesky central bank pumping everything full of liquidity you already would have wouldn’t you? We’re not so different, bitcoiners and value investors.

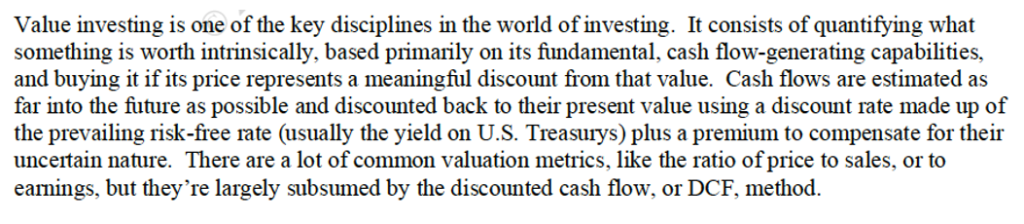

So, what is value investing:

I’m just going to steal the definition from Howard Marks’ latest memo (All of them have a different definition for what value investing is, much like bitcoin. Not so different bitcoiners and value investors):

So, let’s apply some value investing principles to bitcoin.

First up – intrinsic value.

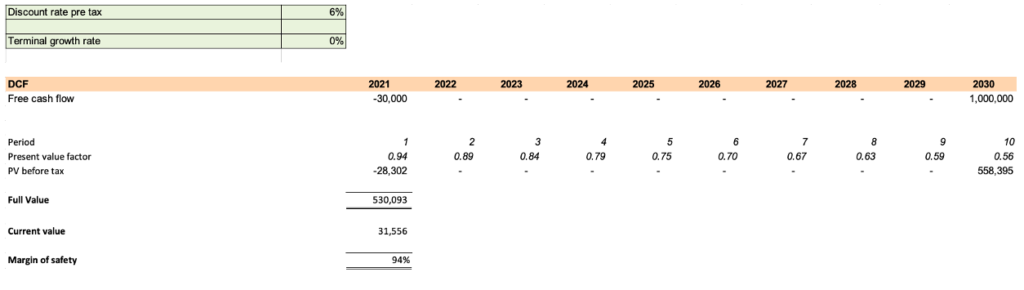

I’ve done a simple DCF based on the fundamental cash flows produced from a bitcoin investment nailing the first requirement for something to qualify for a value investment: to quantify what something’s worth intrinsically, based primarily on its fundamental, cash flow-generating capabilities.

This is the result:

Some notes on my assumptions:

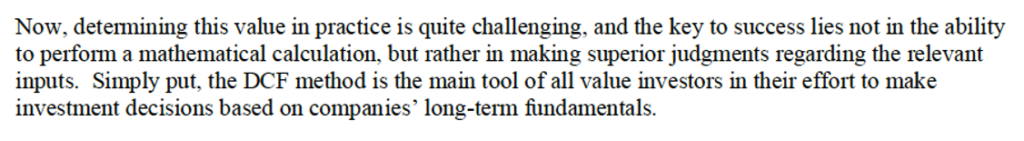

Again, from Howard Marks’ latest memo:

See, the art of value investing lies not in making the most complicated of mathematical computations, but rather in making superior judgements regarding the relevant inputs. So, this amazing and important technique investing boils down to, well, who can suck the best thumb.

So how did I get to my numbers?

Simple buy and sell. One cash flow out, one cash flow in.

“So, you’re just buying and hoping someone will buy it from for a better price! You’re just hoping for a greater fool!” Yes, you old relic, and how is that different from buying a “undervalued” business believing it will eventually get revalued by Mr. Market? Your whole investment thesis is based on someone buying your investment from you at a dearer price. Same as mine. We’re not so different, bitcoiners and value investors.

Cash flow one is a purchase of one bitcoin, roughly trading at $30k, simple. Cash flow two is the sale of your bitcoin for $1,000,000, simple. I can hear value investors screaming and old Ben Graham turning in his grave as I type this. But I calculated that $1,000,000 using fundamental thumb sucking, exactly like value investors calculate the future cash flows of businesses.

So how did I suck the numbers for the $1,000,000 selling price? Fundamental research of course. Simple evaluation of past performance of bitcoin adoption over the last 12 years and extrapolation of that performance into the future. Precisely like any value investor would do for a company he/she is analyzing. We’re not so different bitcoiners and value investors. I’m not going to dig into the details here, not the point of this article (I’m happy to do so with any value investor if they were open enough to listen).

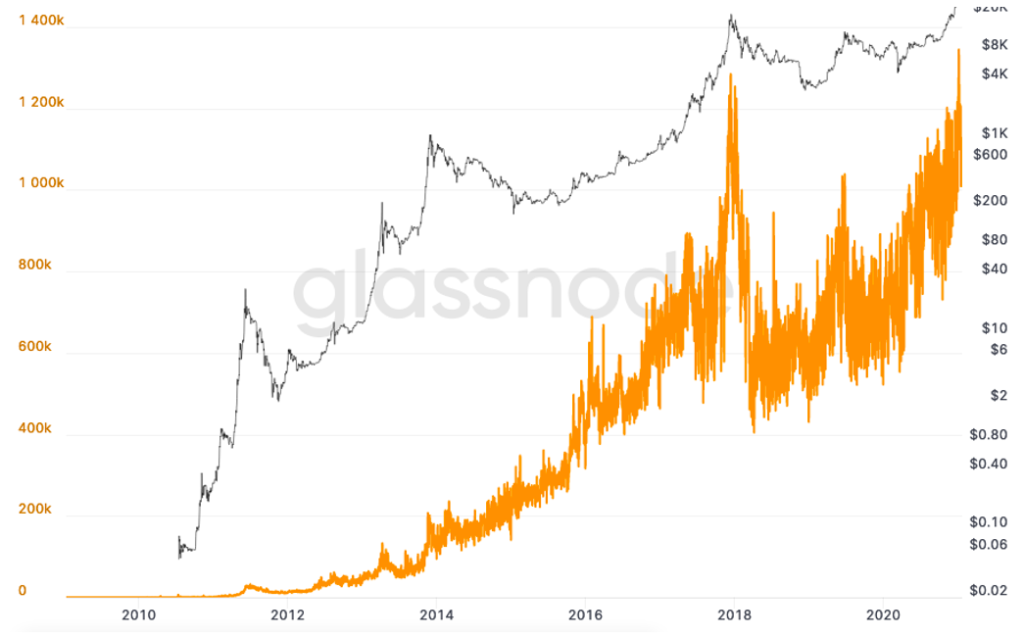

A simple heuristic for bitcoin adoption – active bitcoin addresses. To own bitcoin, you need to have an address, thus the number of addresses that are active is a good proxy for adoption.

Bitcoin active addresses:

Since 2014 the number of addresses has grown from 200k to roughly 1,400k (not precisely accurate but good enough – another value investing mantra). That’s a CAGR of 32% which compares with a CAGR of 98% for bitcoin price p.a. Given that the amount of bitcoin is a fixed supply the growth rate of active addresses should ensure the growth of bitcoin’s price and what you can sell it for.

Based on fundamental research I believe bitcoin is a better form of money than gold or the dollar. Not going to dig into that here, not the point of the article, but happy to argue it out with any value investor if they’re open enough to it.

So, extrapolating the growth of active addresses into the future, I think the $1,000,000 price you can sell bitcoin for in 2030 is rather conservative (another trait of the value investor – not so different, bitcoiners and value investors). Given that only about 3% of the people in the world own bitcoin, I’d say we’re still in the early days of adoption and growth rates should remain pretty strong. A 42% growth rate in bitcoin price is about half the CAGR of the last 6 years. Conservative!

Thus, the DCF gives us an intrinsic valuation per bitcoin of $530,000 in todays money.

A note on the discount rate: I’ve used 6% as the risk-free rate and not the 1% US treasuries are trading on because if you think bitcoin is a bubble, US bonds probably scares the shit out of you (not so different, bitcoiners and value investors, are we?).

Based on the intrinsic valuation for bitcoin we have a margin of safety of 94%! That’s a net-net by Ben Graham’s standards!

Let’s rehash quickly:

Again, from Howard Marks’ memo:

Let’s square the bitcoin value investing circle:

- Acquiring bitcoin is acquiring a stake in a network of value transference, fundamentally better than any the world has thus far seen.

- The true worth (intrinsic value) of bitcoin is $530k based on my fundamentally thumb sucked DCF.

- I used fundamental research to calculate the intrinsic valuation.

- Massive divergence between current price and intrinsic value – 94% margin of safety. SO MUCH SAFETY.

- The emotional discipline to act when such an opportunity is presented and not otherwise. Well, I’m all in. Unemotionally.

There you go value investor. Here’s Mr. Market giving you the opportunity of a lifetime. You going to swing old man?

Last word: Value investing is dead:

Yes old man, you heard me. Value investing is dead. You’ve underperformed for 20 years and you’re being outperformed by a bunch of Robinhood traders that buy stocks that go up and sell them before they go down. You’ve expanded the definition of the term so far that it’s now just an empty word that even bitcoin can fit into. It means nothing anymore. You’ve lost.

We’re not so different, bitcoiners and value investors:

Now, before you dig out this article in a few years’ time when ‘value investing’ has its day again, because it will, remember that in 2018 and 2019 you were the ones saying bitcoin was dead. But look at us now assholes!

See, we’re not so different, bitcoiners and value investors, are we?